property tax liens nj

All tax lien auctions are regulated and controlled by the State of New Jersey. Essex County Tax Board 495 Dr.

Sales Tax Conflicts Where Two States Tax The Same Transaction

HOW TO PAY PROPERTY TAXES.

. In Person - The Tax Collectors office is open 830 am. 250 Real Property Tax Deduction Supplemental Income Form. Are you ready to sell a New Jersey house.

Selling your house to a direct buyer is one of the best ways to stop the frustrations that arise from tax liens. On top of that your investment is 100. Superior Court of New Jersey.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. The codicil specificallyy stated who owned what property. Map More Homes in Cherry Hill.

A New Jersey Property Records Search locates real estate documents related to property in NJ. Property liens can be attached to real estate and. Active Military Service Property Tax Deferment Application.

Since the amount that the bidder must pay for the lien is fixed. Pennsauken NJ currently has 1319 tax liens available as of October 18. Moreover the purchase of tax liens is all governed by statute.

There are currently 139543 tax lien-related investment opportunities in New Jersey including tax lien foreclosure properties that are either available for sale or worth pursuing. The initial duration of the lien is 20. Law Division judgments for money damages are a lien against any real estate owned by the defendant in the State of New Jersey.

Cherry Hill NJ 08034. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Now heirs own those homes separately codicil states they must pay their taxes and upkeep their own properties.

By Mail - Check or money. A property lien in New Jersey is the legal right that a creditor has to obtain assets owned by a debtor if outstanding debts are not paid. The tax applies to all decedents who died after December 31 2001 but before January 1 2018.

This website has been designed to provide property. Property owners who are permanently disabled senior citizens or veterans may qualify for property tax deductions if they meet income and residency requirements. The New Jersey Estate Tax is a lien on all property of a decedent as of their date of death.

Office of the Clerk. BIDDING DOWN TAX LIENS Bidding for tax liens under the New Jersey Tax follows a procedure known as bidding down the lien. Martin Luther King Jr Blvd Room 230 Newark NJ 07102 Together we make Essex County work.

Public Property Records provide information on land homes and commercial properties.

![]()

Tax Sales Tax Collectors Treasurers Association Of Nj

Sales Taxes In The United States Wikipedia

New Jersey Property Tax Foreclosure Tax Sales And Foreclosure Westmarq

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Understanding Nj Tax Lien Foreclosure Westmarq

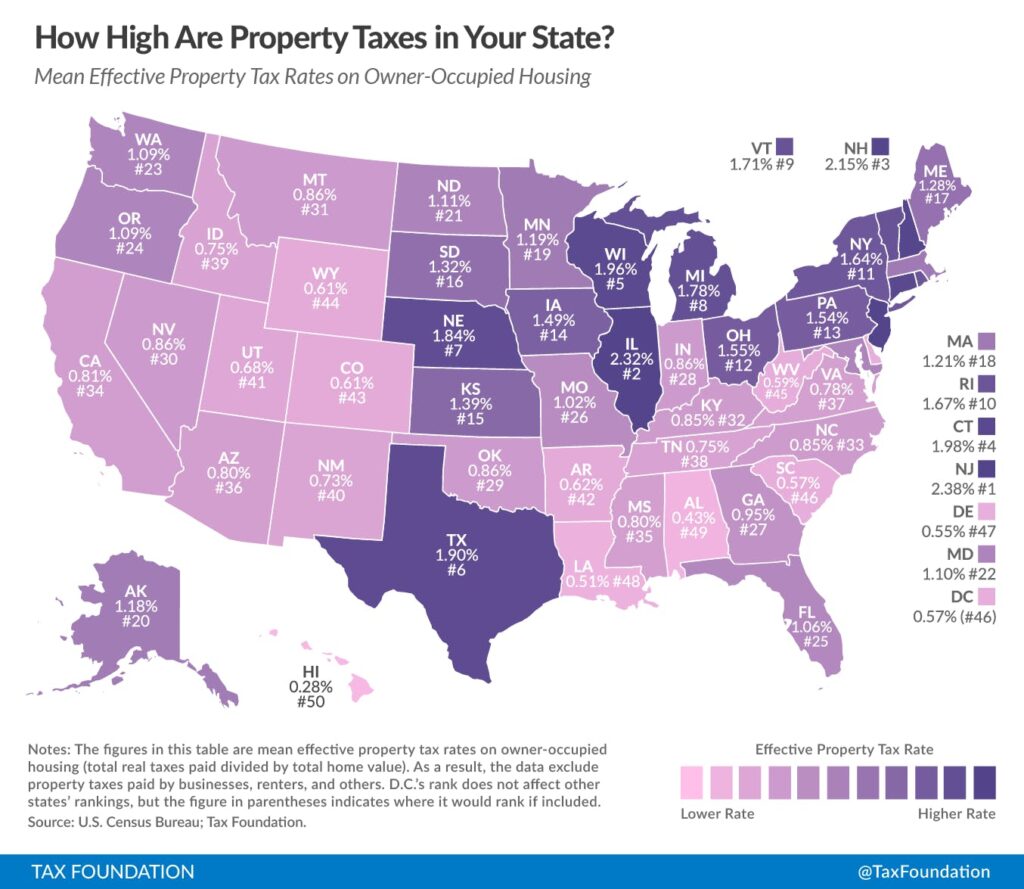

2022 Property Taxes By State Report Propertyshark

Common Issues Facing Commercial Businesses Seeking Property Tax Relief Nj Com

Investing In Tax Liens Alts Co

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

New Jersey Tax Sales Tax Liens Youtube

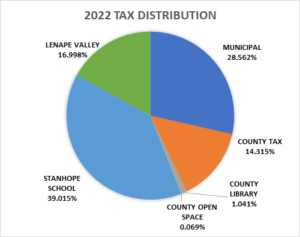

Tax Finance Dept Sparta Township New Jersey

Tax Finance Dept Sparta Township New Jersey

Tax Lien Law Haunts Massachusetts Property Owners